PHILADELPHIA – A new study of Philadelphia’s 10-Year Property Tax Abatement finds the program’s benefits will continue to outweigh its costs in the long-term, although that crossover point takes longer to reach than four years ago because of the strong real estate market.

The study was commissioned by the Finance Department and conducted by the firm Jones Lang LaSalle, which also produced the last analysis, in 2014. The new report looks at options for changing the abatement developed by JLL with input from the Administration and members of City Council. The analysis looks at the impact of those options on likely new development, construction jobs, and City and School District tax revenue.

“Gauging the value of the abatement is difficult, since we’re trying to estimate what would have happened had the incentive not been in place,” said Finance Director Rob Dubow. “Nonetheless I’m confident that this new study will provide sustenance to the robust discussions taking place on the future of the abatement, in the larger context of the Mayor’s proposed budget now before City Council and the need to adequately fund the Philadelphia School District.”

The Context: The 10-year abatement of Real Estate Taxes, enacted in 1997, exempts from tax the added value from new construction or rehabilitation of both residential and commercial properties, allowing the property owner to pay no tax on improvements for the full 10-year period. However, those receiving abatements do pay taxes on the value of the land.

Out of the 580,000 parcels in the city, 15,359 properties (3%) had active abatements in 2017. New construction accounts for about 53% of all abatement volume (8,185 properties). Therefore, nearly half of properties receiving the abatement are for existing housing stock that has been upgraded or stabilized.

The Study: The study evaluated the expected development volume, jobs, and tax revenue of the current abatement program and considered the impact of modifying the current abatement by:

- Eliminating or significantly limiting the term of individual abatements;

- Gradually phasing out individual abatements;

- Capping individual abatement values;

- Basing abatements on geography.

The Key Findings:

- Changes to the abatement are likely to lead to a reduction in the number of projects developed in the city. Over a 30-year period, the current program is still projected to generate more development, jobs, and tax revenue than scenarios that modify or even eliminate the incentive.

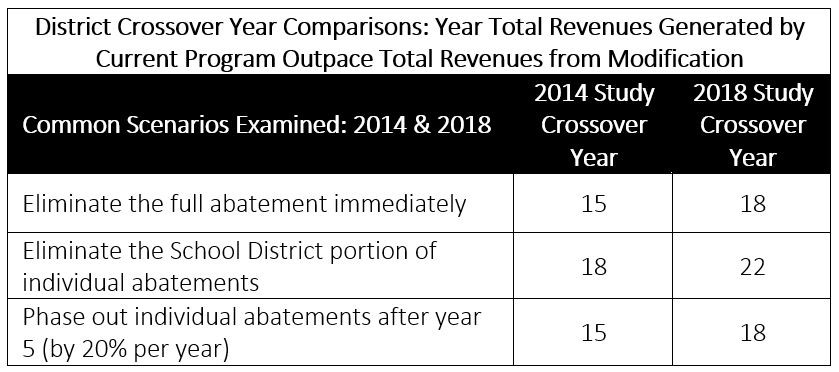

- The crossover point — the point at which revenue to the School District under the current abatement is greater than revenue from other options — ranges from 18 to 22 years. For example, eliminating the abatement entirely will be a net positive to the School District for 18 years, but after that it would be a net negative because of lost development. The crossover point for another scenario — phasing out individual abatements over five years — is also 18 years. The crossover point for a third scenario — eliminating the School District portion of the abatement — is 22 years.

Compared to four years ago, the crossover points for these scenarios comes later, because of our current strong market. The range of crossover points in the 2014 study was 15 to 18 years. Now, as noted above, it is estimated at 18 to 22 years:

The Options: Following are the study’s conclusions regarding the four general options examined by JLL. While retaining the abatement in its current form is projected to generate more revenues over 30 years, changing the abatement would generate additional revenue in the short term:

- Eliminating or significantly limiting the term of individual abatements: Over a five-year period, completely eliminating the abatement generates an additional $7.8 million for the District. Eliminating only the School District portion of the abatement generates an additional $9.2 million for the District over five years, the largest five-year gain of any scenario examined.

- Gradually phasing out individual abatements: Gradually reducing the abatement over time reduces the risk of development loss and related tax revenue loss because it allows developers time to adjust construction and financing strategies to account for these changes. For residents, a gradual reduction in the abatement allows homeowners a chance to absorb the incremental property tax increases over time.

- Capping individual residential abatement values: Among the proposals for modifying the abatement, ones that cap the abatement on residential properties at a certain threshold yield the most revenue for the City and School District over 30 years. This study does not examine the impact of value caps to commercial properties. Capping the value on commercial would have a disproportionate impact on commercial projects, which may depress development and cost jobs.

- Basing abatements on geography: Limiting the abatement to certain areas of the city is unlikely to spur development in neighborhoods with low usage now unless it is coupled with an enhancement to the value of the abatement.

What’s Next: As policy makers and stakeholders engage in a discussion of whether and how to change the program, this study provides a foundation to understand how each option will impact tax revenue, jobs, and development in Philadelphia.

The study, along with a 4-page overview and the 2014 study, are available here.