Have you ever looked at the bottom of your bar receipt after a night out with friends? You might notice a tax in the total. Do the math and you might also notice the tax amount is more than Philadelphia’s 8 percent Sales Tax. Why? Since 1995, a 10 percent tax on retail sales of alcoholic beverages provides funds that go directly to the School District.

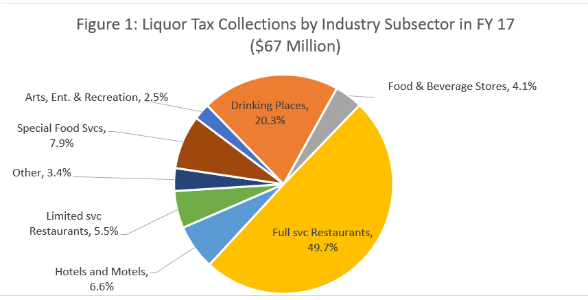

When you buy a beer, a glass of wine or a cocktail, the venue (bar, restaurant, hotel) collects the Liquor Tax for you. Can you guess who’s ringing up the biggest tab in Philly? Full-service restaurants, rather than bars, collect the most Liquor Tax—and by far. They are responsible for almost half of all collections.

Together with bars and taverns, full-service restaurants represent 70 cents of every dollar in Liquor Tax collections. The remaining 30 cents sprinkle in from hotels, motels, limited service restaurants, grocery stores, private clubs, casinos, and catering companies.

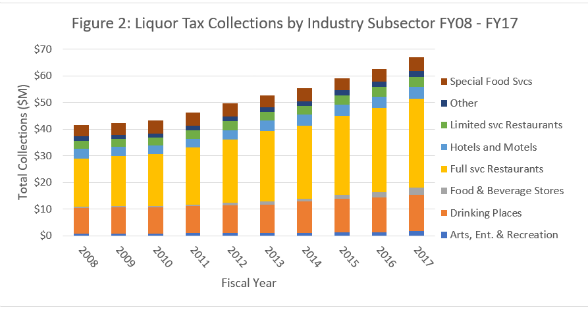

Liquor Tax collection has increased 62 percent since the 2008 fiscal year. But it has grown in some areas more than others. Food & Beverage stores saw the largest increase in the past 10 years: over 500 percent. Limited-service restaurants only saw a 17 percent increase during that time.

These are some of the reasons collection has increased:

- Research suggests Americans are drinking more.

- Pennsylvania has relaxed some liquor laws, like allowing grocery stores to sell beer and wine.

- Philadelphia simply has more restaurants than it did in 2008.

- The Department of Revenue has improved its enforcement.

The most important of these factors has been the City’s collection efforts. In 2014, the City began using liquor license and sales data from the PA Liquor Control Board to identify businesses that did not file Liquor Tax returns, or under-reported sales. The City began issuing notices to shut down businesses that underpaid. No surprise, businesses prefer to remain tax compliant rather than face closure.

These methods have helped the City recover millions of dollars for students. Without them collection levels today would probably be close to what they were back in 2007.

Photo credit: C. Smyth/VISIT PHILADELPHIA®